MYANMAR

Determined

Hustlers

driven, dynamic, aspiring

21% of adult population | 8.2 million people

Mostly young, middle-high income, single, urban men working as casual laborers or self-employed. Just half participate in household decision making. Their financial health is mixed, driven by volatile incomes and struggles to pay household bills, despite strong expense planning and goal-oriented savings. Over half of save, and at leading rates with informal groups. Just over half borrow, mostly from family. They mostly manage money socially and are Myanmar’s most frequent users of technology and formal services. They are open minded but have a low sense of self-efficacy and may lack confidence.

Determined Hustlers

Myanmar Average

FINANCIAL DECISIONS

self-employed

28%

29%

formally employed

13%

6%

EDUCATION

secondary education

19%

14%

tertiary education

11%

7%

PHONE

own a smartphone

69%

49%

own a feature phone

12%

17%

LAND

own land personally

29%

42%

own land communally

42%

37%

GENDER (MALE)

63%

50%

AGE (25-34)

GEOGRAPHY (URBAN)

51%

34%

SOCIOECONOMIC

50%

SES 4-5

FORMAL ACCOUNT

OWNERSHIP

12%

7%

INFORMAL

FINANCIAL USAGE

35%

40%

MOBILE WALLET

OWNERSHIP

1%

1%

TECH USE

(HIGEST FREQUENCY)

65%

35%

42%

23%

DEMOGRAPHICS

Who are they?

“I was embarrassed to sell betel nut at first, because people

might look down on me. Betel nut sellers aren’t from well-off families. But I told myself that I’m not doing anything illegal.

It’s a respectable business.”

HTUN

PRIMARY SOURCE OF INCOME

Determined Hustlers

Myanmar Average

Demographics

Determined Hustlers are often single, young, urban men in higher SES quintiles who despite their better education still tend to be junior members in their households. Most are casual laborers or small business owners, and many more are formally employed than is typical of other segments.

Social Network

While Determined Hustlers speak regularly on the phone to a significant number of people daily, they are less religiously active than average, and their supportive social network is smaller than one might expect given their social phone use. Despite above-average social networks, they rely on social sources for emergency resilience at rates virtually identical to the national average and express significant insecurity about their ability to raise emergency funds, even with high trust in people. A significant portion of their social networks might be economic connections rather than personal ones, making it difficult to rely on that network for emergency sources of funds.

NUMBER OF PEOPLE TALKED TO IN A DAY

Determined Hustlers

Myanmar Average

ASPIRATIONS

What do they want?

Determined Hustlers seek growth opportunities that create avenues to increased

financial independence and ability to carry through on their plans.

BEHAVIOR

How do they manage their finances?

“I would never take out a loan, except to open a drug store,

maybe in 2 years for start-up money if others don’t offer to help.

If the person I borrowed from wouldn’t really be affected, I would borrow. But if it could hurt them, I wouldn’t borrow from them.”

HTUN

Financial Behavior Overview

Although Determined Hustlers are mostly young, educated, urban and often formally employed or small business owners, they are also infrequently financial decision-makers in their households, and a significant number report they are day laborers with more volatile incomes than average. These factors likely converge in their below-average financial health, particularly in their ability to plan their spending and cultivate receivables.

BEHAVIORAL INDEX

FINANCIAL ACCESS

Determined Hustlers

Myanmar Average

Financial Access

Determined Hustlers primarily manage their money through family, informal groups, and friends, though thy are almost twice as likely as average to own formal accounts (12% compared to 7% nationally). Like the rest of the country, they report almost no mobile wallet ownership. In general, they borrow more from family and save more with informal groups.

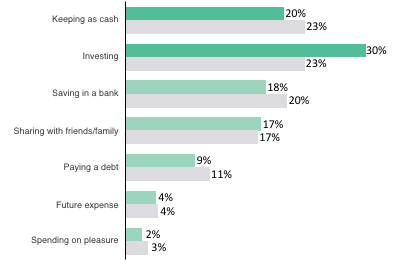

Financial Priorities

Determined Hustlers would allocate the largest portion of a windfall toward investment, prioritizing investing far more than any other segment, and would keep the second largest portion at home in cash. Following that, they would allot equal amounts to bank savings and to friends and family. These priorities seem aimed at increasing their ability to grow and manage finances that they can control, establishing independence, the ability to pursue goals, and, at the same time, cultivating social creditworthiness.

HOW WINDFALL IS PRIORITIZED

Determined Hustlers

Myanmar Average

MAKES A PLAN AND FOLLOWS THROUGH

Determined Hustlers

Myanmar Average

Financial Plans

Most Determined Hustlers consider themselves effective planners and maintain an expense plan. Like most other people in Myanmar, Determined Hustlers are highly conscientiousness, which likely driver their planning. Their strong disposition to plan and set goals contrasts with their lack of household financial decision-making authority. This perhaps reveals an unfulfilled ambition to guide their own financial growth and development.

Shaping Income and Expenses

Although Determined Hustlers skew wealthier, about half experience high income volatility, more than average for Myanmar, driven by unreliable earnings through casual labour and self-employment. This, together with their limited authority over household financial decisions, drives challenges managing income and expenses. They have faced more types of types of emergencies in the past two years and more types unpaid household expenses over the past six months than average for Myanmar. This comes despite the fact most identify as effective planners and four-fifths report having an expense management plan.

INCOME VOLATILITY

Determined Hustlers

Myanmar Average

SAVINGS CHANNELS

Determined Hustlers

Myanmar Average

Building Reserves

Over half of Determined Hustlers are highly deliberate savers, with specific goals in mind, second only to the Community Entrepreneurs. Yet, three-quarters feel that they do not make enough money to be able to save, though their savings rates are above average for Myanmar. Already capable savers, they may find themselves at the limits of their ability to progress using reserves alone and could be prime candidates for responsible use of small business investment loans if the rates are competitive and the terms are made transparently and comprehensibly. Half feel their savings are vulnerable to the demands of those around them, though two-fifths feel their savings are safe. Over half of Determined Hustlers lack decision making power in the home and their savings may be especially susceptible to claims.

Cultivating Receivables

Just over half of Determined Hustlers borrow, though they do so less infrequently at rates below the national average. Only one fifth borrow quarterly or more. In spite of their comfort with debt, they prefer to borrow from family over informal groups or formal providers. Although they own more formal accounts than other segments, virtually none use them. Credit through family is likely more affordable, accessible and, for those without decision making power, may be the only channel permitted. Although they frequently experience unmet household needs and aspire to invest, they may not be empowered to borrow.

BORROWING CHANNELS

Determined Hustlers

Myanmar Average

PHONE USAGE

Determined Hustlers

Myanmar Average

Technology Usage

Determined Hustlers use tech at a high frequency. They are the most likely segment to own a smart phone, which most do, and they speak to more people on the phone than any other segment.

They are more than twice as likely as average to frequently send SMS messages, use social media, use the internet, log into web-based accounts, or use computers.

PSYCHOLOGY

How do they think?

“Here, people save in gold. I was glad I had jewelry to pawn

when I needed it. The pawn shop’s interest rates are good.

If I saved in cash, the money would just get spent. If I save in gold, I don’t have to ask for help, which would be disgraceful.”

HTUN

Self-perception

With half expressing moderately high belief in their ability to influence events around them, Determined Hustlers exhibit an above-average locus of control and higher than average self-esteem. However, they report very low self-efficacy and, accordingly, low confidence in their future. Determined Hustlers appear to believe they can improve their lives, although by limited degrees, and they seem not to feel they have a clear, feasible path forward from where they already stand, or little capacity in their households and careers to advance such a strategy.

LOCUS OF CONTROL

Determined Hustlers

Myanmar Average

CONSCIENTIOUSNESS

Determined Hustlers

Myanmar Average

Conscientiousness, Spending Impulsivity, and Openness

Determined Hustlers are highly conscientious, though trail the national average for Myanmar. They are also unimpulsive in their spending, second only to Reliable Planners. This combination of high conscientiousness and low spending impulsivity drives their strong financial planning, and for those who lack decision making power in the household, may cause friction with family and especially the head of household. Like all other segments except Cautious Individualists, they are very open minded, proving adaptable, creative, curious, and open to new experiences.

Attitude Towards Savings

And while most save deliberately with specific goals in mind, they nevertheless believe their savings are vulnerable to the demands of those around them. And three-quarters feel that they do not make enough money to be able to save anyways. Already capable savers, they may find themselves at the limits of their ability to progress using reserves alone and could be prime candidates for responsible use of small business investment loans if the rates are competitive and the terms are made transparently and comprehensibly.

IMPULSIVITY

Determined Hustlers

Myanmar Average

COMFORT WITH DEBT

Determined Hustlers

Myanmar Average

Attitude Towards Debt

Determined Hustlers view themselves as highly dependable at rates well above the national average, and nearly half are very comfortable holding debt, though nearly a third are not. However, they are the most comfortable segment holding debt. Yet they still prefer to borrow from the safest channel – family. This may suggest an opportunity for providers to extend formal and mobile loan products to this segment, especially given their leading rates of tech usage and comfort with financial services.

Trust in People

Like most in Myanmar, Determined Hustlers trust the people in their communities and in their social financial networks, and they prefer to work with those who they know well — all reflected also in their financial habits. While only one-quarter of the segment see their communities as equal, and likely feel keenly the gap between their own independence and life stage and that of those around them, most still maintain high confidence in their community’s willingness to support their businesses and their children’s education. Indeed, they are more than three times as likely to rely on social or informal sources of funds in emergencies as they are to rely on personal sources.

PERCEIVED COMMUNITY EQUALITY

Determined Hustlers

Myanmar Average

RESPECT FOR AUTHORITY

Determined Hustlers

Myanmar Average

Trust in Institutions

Determined Hustlers report moderately-high trust in banks, with which they are more likely to be familiar given their proximity and higher rates of account ownership. Nevertheless, usage lags, perhaps presenting an opportunity to meet the segment with investment tools that match their ambition to their levels of independence in their households. While still young, they may be reluctant to demand independence from those household and community authorities, being very likely to believe generally that authority figures deserve to be shown respect.

USER PROFILE

Htun

"When our income gets higher, we can become more disciplined. At our current level, we have to tap our savings."

—

Htun lives in Yangon with his wife, where he runs a betel nut stall.

Previously a druggist in family-owned stores, he still aspires to return to that trade

after he’s saved enough to start a drug store of his own back home, in the region where

his children live with his in-laws. The lower class perception around his otherwise successful business frustrates him. He aspires not only to success, but to legitimacy.

USER INSIGHTS

Rising Income, Sluggish Status

Htun moved to Yangon for the economic opportunities, but he doesn’t come from a poor family. The move was motivated by ambition, not poverty. He found a strong business opportunity as a betel nut vendor. It improved his quality of life but diminished his social status due to the low respect his friends have for the profession.

Success without recognition feels like incomplete growth to Htun. He’s a willing, motivated hustler who needs validation for his hard work and for the improvement he has brought to his household. Without that, he’ll soon abandon Yangon and his business to profoundly shift his career in the hopes of achieving social affirmation.

Secure Savings, But Costly to Use

By saving primarily in gold, Htet feels he secures his earnings against depreciation or careless use because gold holds its value and must be converted before it can be spent. However, converting his gold savings to cash when he experiences a shock can be costly. He pawns it, then recovers the same gold later only after paying interest.

It’s possible that the cost of use is a motivator to leave the gold savings untouched. This may help him accrue larger sums for his long-term goals. His wife wears the gold he saves, so he can easily see and monitor his savings. Such a display increases his social capital. And it’s possible that by paying interest to recover the gold, he never feels like he’s actually given up his savings — only done without part of it for a time.